Golden years or growing fears: How is each generation planning for retirement?

Key takeaways:

- While 93% of Gen Zers already have a retirement plan, 21% of millennials and 16% of Gen Xers admit to being unprepared, with a quarter of all respondents unable to survive more than a month on their current savings.

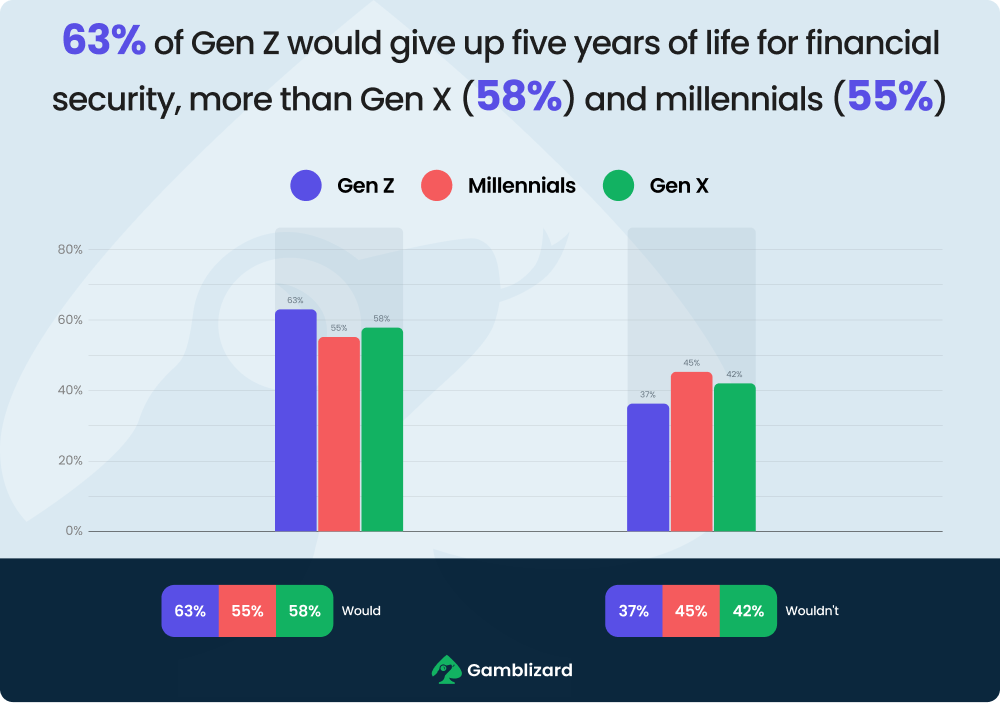

- 64% of Gen X, 58% of Gen Z, and 55% of millennials would trade five years of their life for financial stability.

- Some 65% fear running out of money more than death, with 56% of Gen Xers afraid they won’t be able to cover their medical expenses, 31% of millennials their everyday essentials, and 44% of Gen Zers worried about housing.

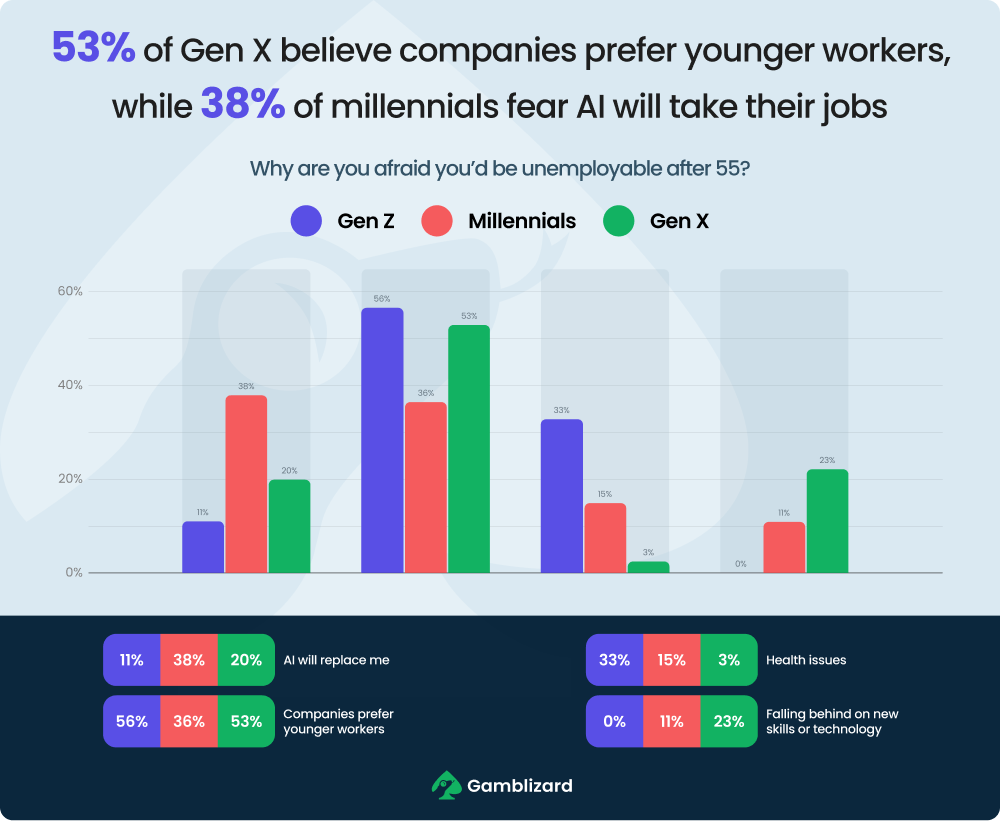

- Likewise, 60% of Gen Xers fear losing their job before retirement, while 38% of millennials are concerned AI will take their job.

After years of hard work, retirement is a time to kick back and enjoy the fruits of our labor. Or at least it used to be.

With wages stagnant, costs rising, and the economic outlook uncertain, many fear that a comfortable retirement may be a luxury they can’t afford.

Retirement reality check: How prepared is each generation for retirement?

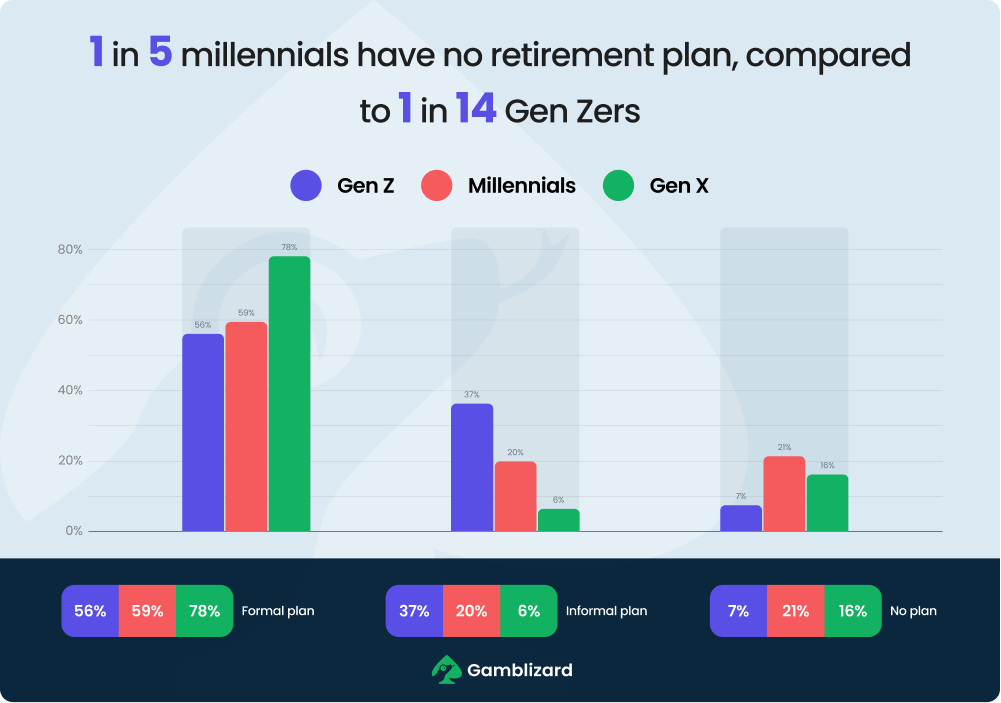

Fresh out of school and just stepping into the workforce, Gen Z is already looking ahead to retirement, with 93% saying they have a plan in place.

However, as workers age, spend their savings, and financial realities hit, retirement becomes tomorrow’s problem, with 21% of millennials and 16% of Gen Xers admitting they have no plan whatsoever.

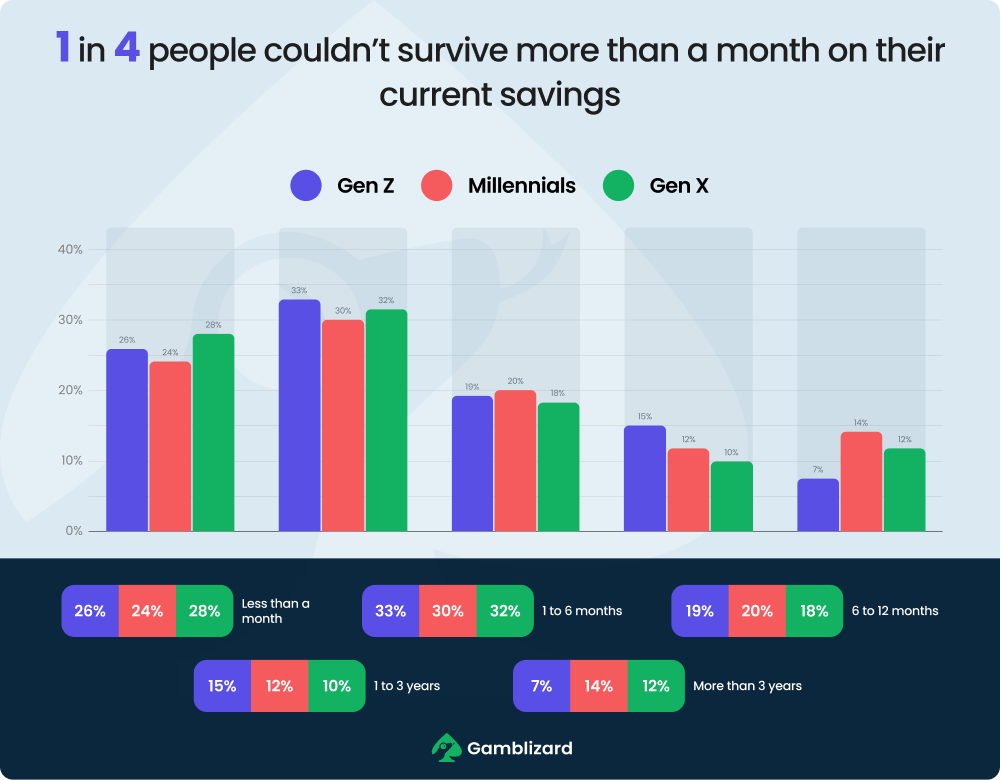

Planning for retirement is one thing, but actually saving for it? Across generations, 26% couldn’t survive more than a month without a paycheck, let alone years.

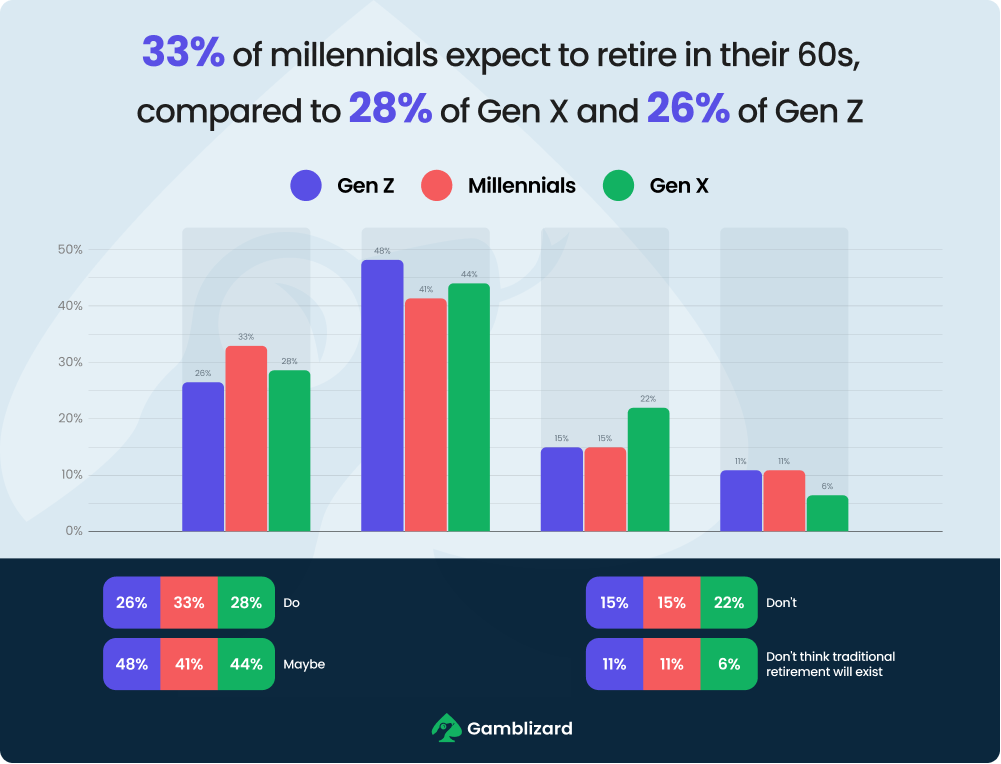

The average age to call it quits is 64, but few are optimistic about retiring in their 60s. Just 33% of millennials say they will, and even fewer Gen Zers (26%) and Gen Xers (28%).

For many, growing financial pressure and rising pension ages are making retirement feel out of reach, with 11% of Gen Z and millennials convinced it will soon be a distant memory.

Piggy banks and pension plans: What is each generation setting aside?

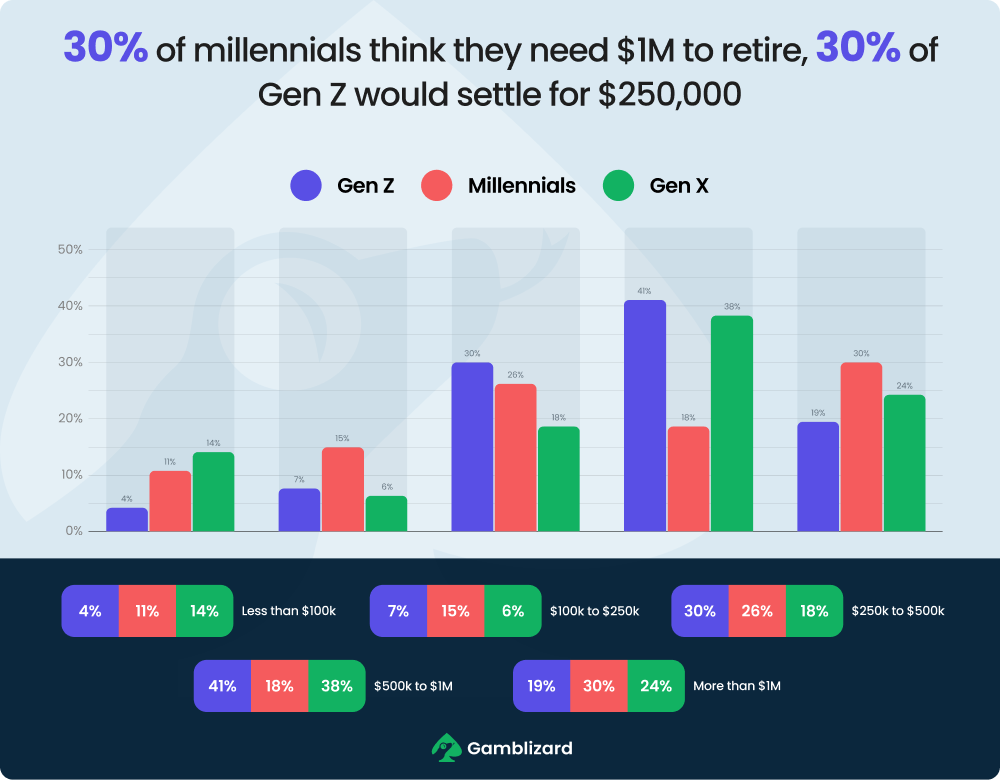

Millennials aren’t just aiming to retire; they’re aiming to retire comfortably, with 30% believing they need over $1 million in the bank before they call it a day on their careers.

With experience (and reality) tempering their expectations, Gen X has set its bar lower, with 38% saying $500,000 to $1M is enough, and 41% of Gen Z shares their modest outlook.

Generations might not agree on what a comfortable retirement looks like, but they’re united on what it’s worth. Some 64% of Gen X, 63% of Gen Z, and 55% of millennials would trade five years of their life for a financially secure future.

Sacrifices for security: What would each generation give up to get ahead?

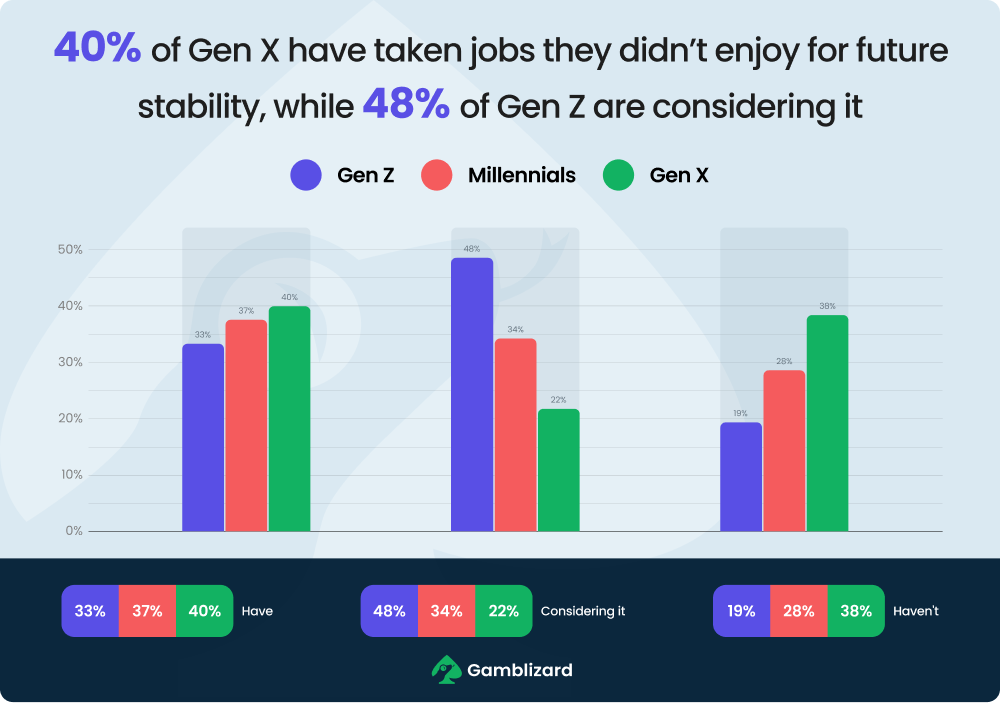

The financial climate is forcing many to put their dreams aside and pursue a large pension pot instead. Some 40% of Gen Xers and 37% of millennials admit to sticking it out in jobs they don’t enjoy for financial stability, and 48% of Gen Zers are considering swapping their passion for a decent paycheck.

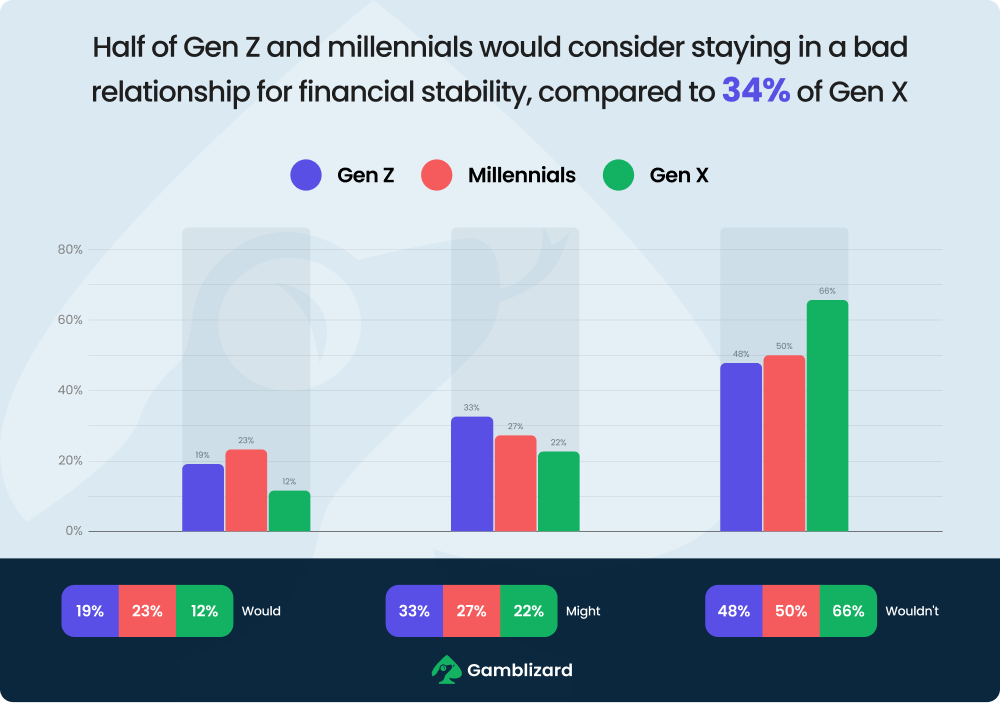

For many, the sacrifice doesn’t stop at five. The financial pressures follow them home, with 52% of Gen Zers, 50% of millennials, and 34% of Gen Xers admitting they would or might stay in a bad relationship for financial peace of mind.

Big cities and business hubs are great for earning, but not so much for saving.

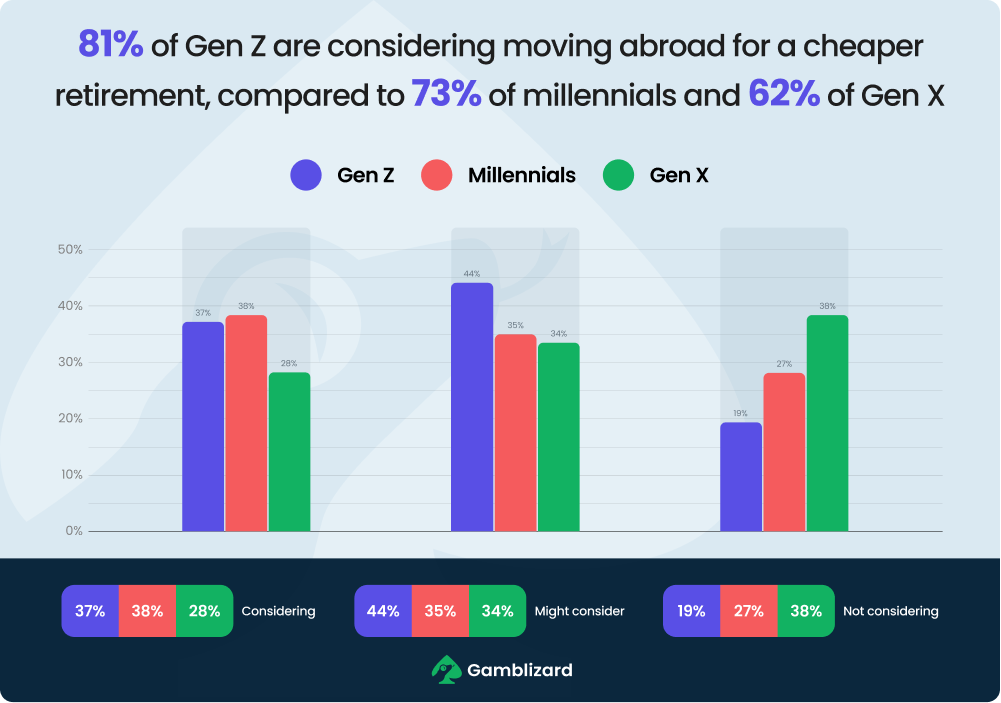

Regions like Southeast Asia, Latin America, and Eastern Europe offer a high quality of life on a much smaller budget, with 62% of Gen Xers considering a move to make retirement more comfortable, and 73% of millennials and 81% of Gen Zers open to joining them in the future.

The best way to build your pension? Start early, contribute regularly, and give compound interest time to work.

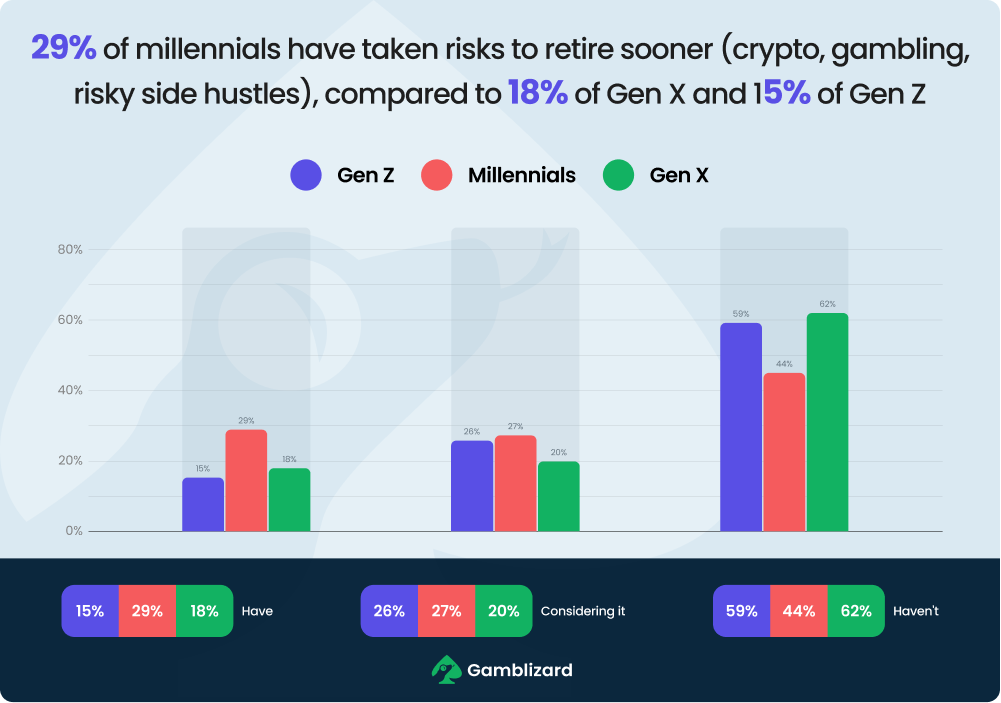

But many millennials aren’t content with waiting. Nearly 29% have taken bold risks – gambling on crypto and going all-in on GameStop – in a bid to retire early, compared to 18% of Gen X and 15% of Gen Z.

Running out of time money: The retirement fears that keep us up at night

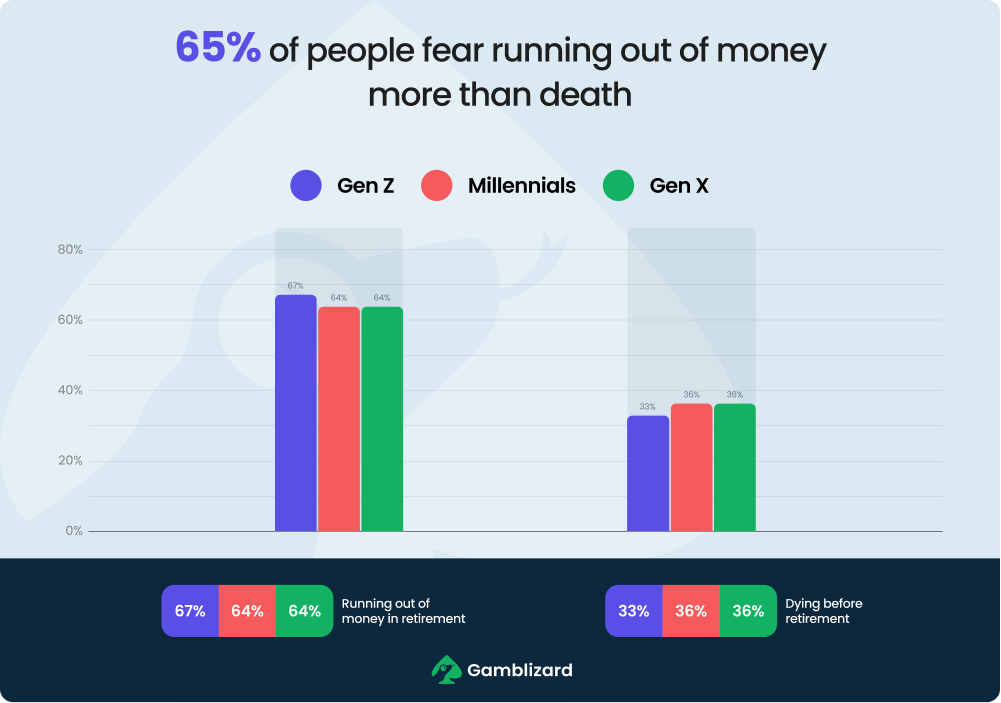

Who has time to worry about mortality when there’s money to fret over? Across Gen Z, millennials, and Gen X, 65% agree that running out of money is a far scarier prospect than dying.

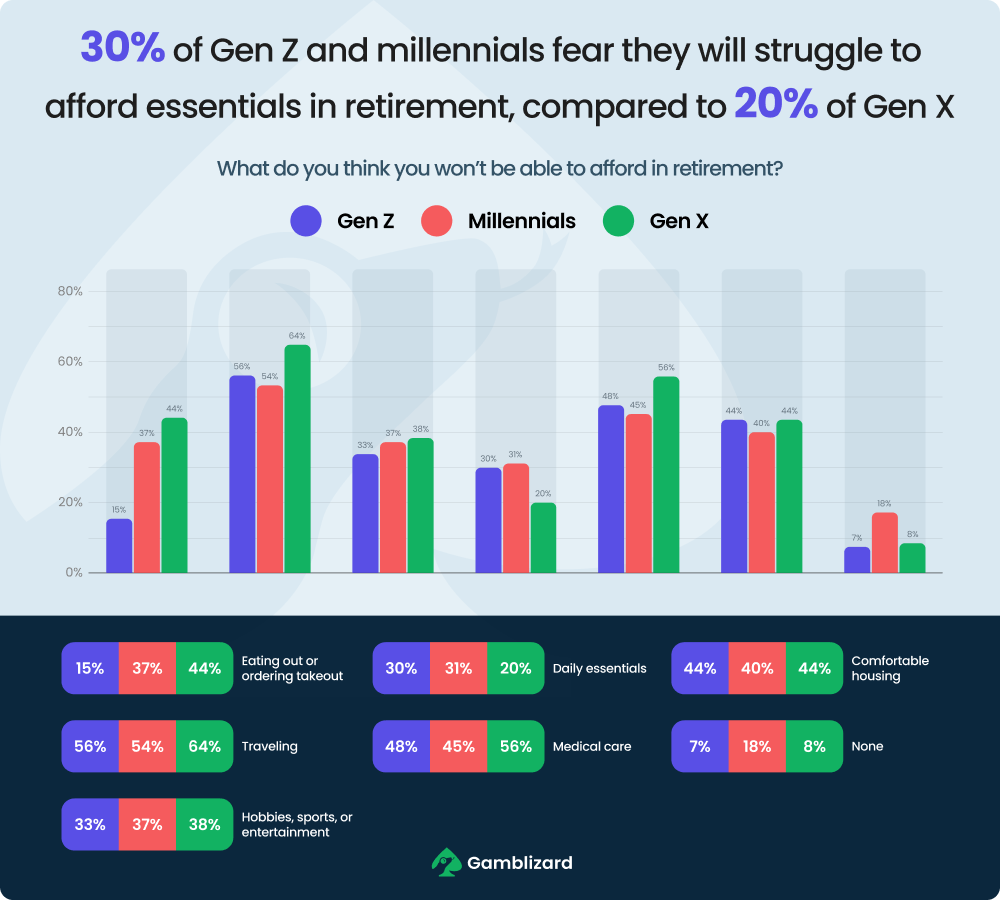

Some 58% worry they will have to give up jet-setting, 32% are concerned that takeout could be off the menu, and 36% dread the prospect of dropping their hobbies.

But it isn’t just losing luxuries that make us fear retirement: 56% of Gen Xers worry about covering medical costs, 31% of millennials about affording daily essentials, and 44% of Gen Zers about finding comfortable housing.

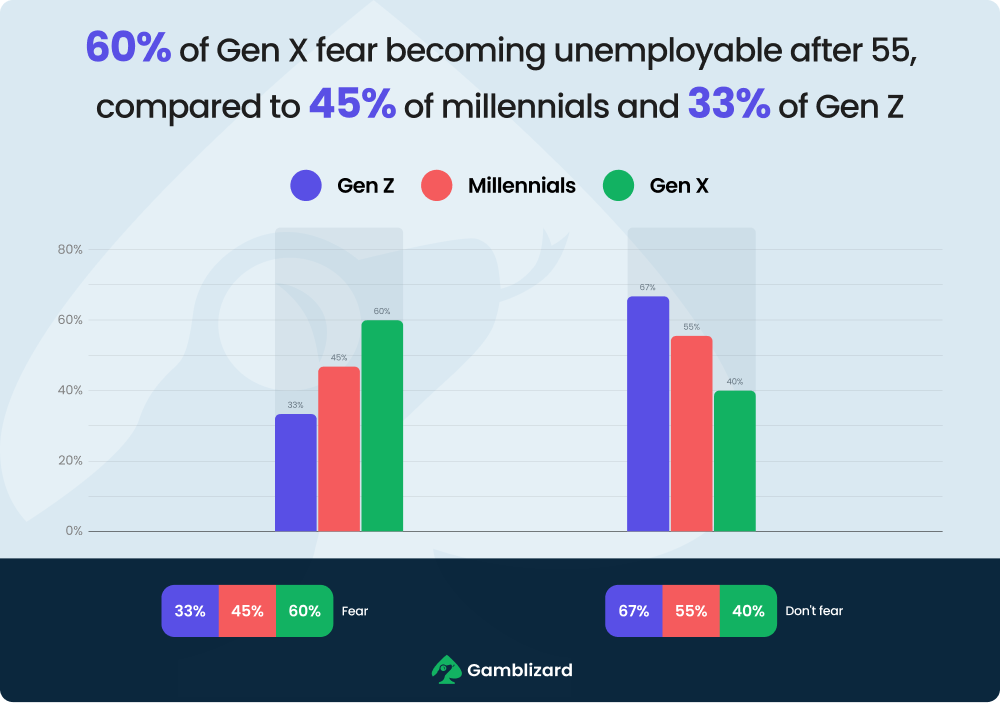

But before we can worry about retirement, we have to make it there first. Some 60% of Gen X, 45% of millennials, and 33% of Gen Z fear their employers could cut them loose after 55, taking a decade of savings off the table.

Why the worry? Because there’s always someone younger willing to work harder for less, or a well-trained machine that never asks for a raise or a break.

Some 56% of Gen Z and 53% of Gen X say companies simply favor the young, while 38% of millennials fear AI is gunning for their jobs.

Saving for yourself… and everyone else: The intergenerational retirement trap

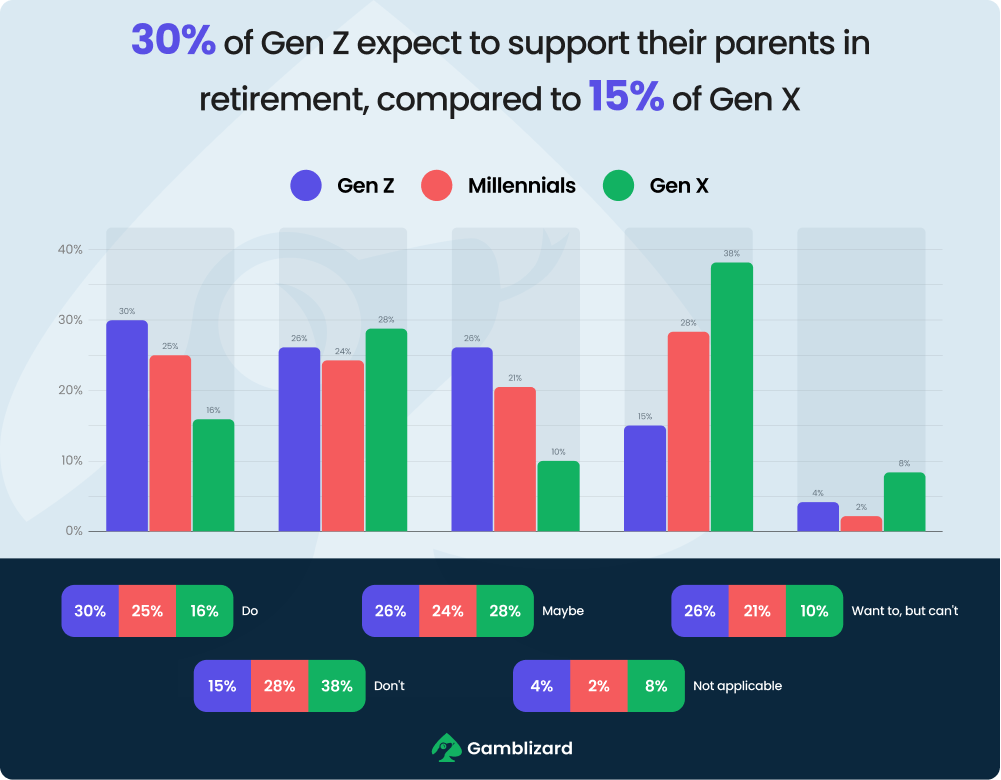

Retirement planning isn’t just about securing your own future – it’s increasingly about covering the shortfall in our parents’ pension pots too. Nearly 30% of Gen Z and 25% of millennials expect to have to support their parents in later life, compared to just 15% of Gen X.

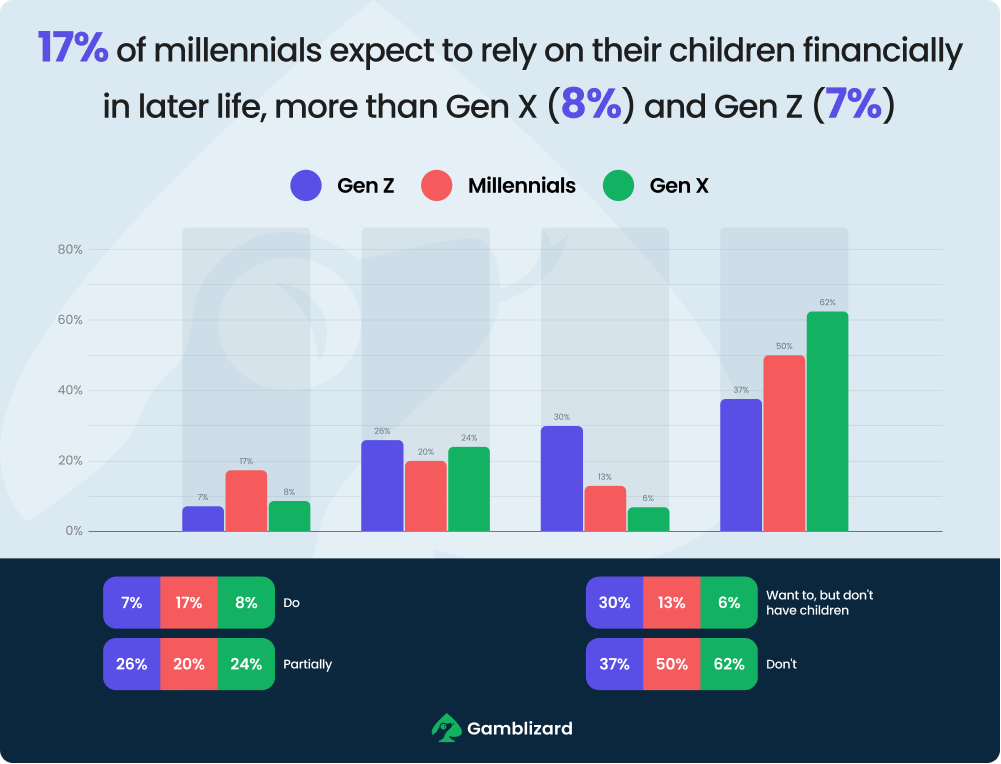

But that generosity isn’t without reward. It’s about paying it forward – and when it’s their turn to retire, 37% of millennials, 33% of Gen Z, and 32% of Gen X will expect their children to pick up at least part of the bill.

We’re supposed to look forward to retirement. Yet, with economic pressures, dwindling pensions, and AI pushing for our jobs, it’s becoming a source of fear, rather than freedom, across all generations.