How Women and Men Spend Their Money

Key Findings

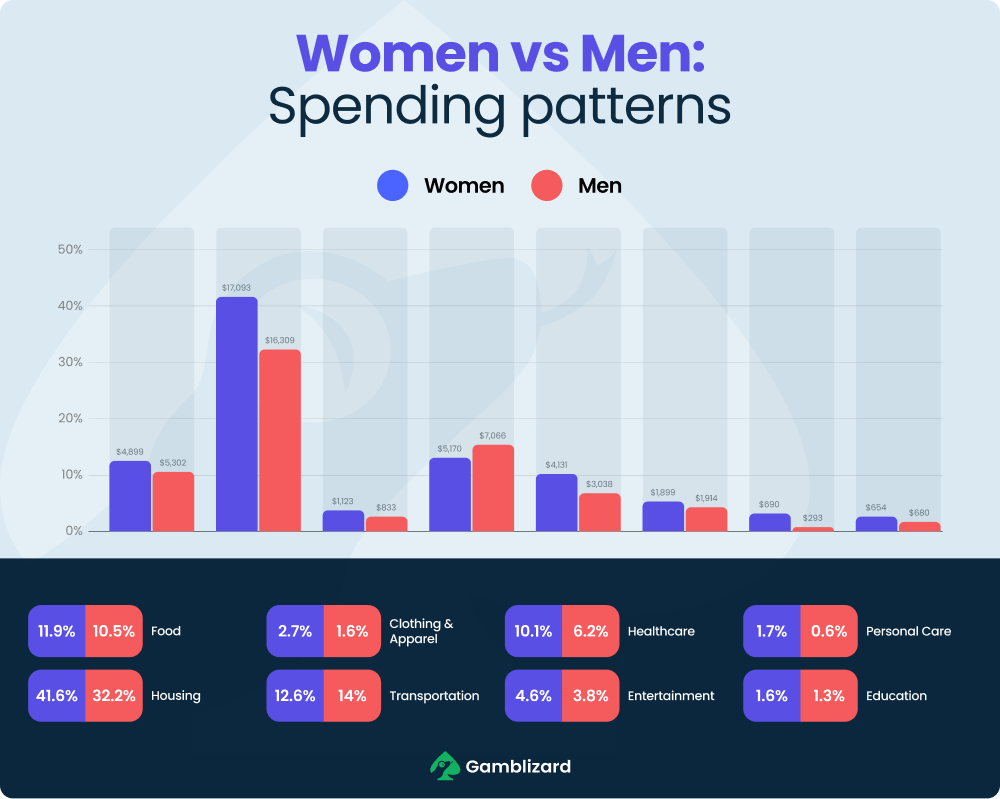

- Essentials dominate women’s budgets: housing, food, healthcare, and transportation account for 76.2% of women’s spending, compared to 63% for men.

- Housing costs hit women harder: Women dedicate 41.6% of their income to housing, versus 32.2% for men.

- Healthcare spending gap: Women spend 10.1% of their income on healthcare, while men spend just 6.2%.

- Clothing and apparel: Women spend almost twice as much as men (2.7% vs. 1.6%).

This isn’t just about the pay gap (though it’s real). And it’s not just about different spending patterns. It’s the combination of the two that makes the difference.

Gamblizard analyzed spending data for single men and women across the U.S., shifting the lens from raw dollars to percentage of income. A $5,000 bill means one thing if you’re earning $50,000, and something very different if you’re earning $41,000.

Housing is where the gap starts to show. For single women, nearly half of their income is gone the moment the rent or mortgage is paid — about $17,093 a year. Single men spend roughly the same amount in dollar terms ($16,309), but for them it’s only 32.2% of what they earn. That difference alone sets the tone for the rest of the budget.

Healthcare only adds to the strain. Women hand over $4,131 a year — 10.1% of their income — compared to men’s $3,038, or 6.2%. In other words, women devote almost double the income share to staying healthy, a gap likely influenced by medical needs and reproductive health coverage.

Food tells a similar story. Even though women spend less in absolute terms ($4,899 versus men’s $5,302), the smaller paychecks mean a bigger percentage of income — 11.9% for women compared to 10.5% for men.

Women outspend men on clothing and apparel too ($1,123 vs. $833), but it’s a small share of the budget (2.7% vs. 1.6%).

Transportation is the one area where men clearly outspend women. They drop $7,066 a year (14% of income) on getting around, whether that’s owning a car, racking up commuting miles, or leisure travel. Women spend less here at $5,170 (12.6%), but when so much of their budget is already tied up in essentials, the difference offers little relief.

Methodology

Gamblizard analyzed data from the U.S. Bureau of Labor Statistics for single men and single women, supplemented with Bankrate research on gender and debt. Rather than comparing raw dollar amounts, we expressed each spending category as a percentage of average annual income — $41,119 for women and $50,634 for men to provide a clearer picture of financial impact.